24+ Mortgage to salary ratio

Were Americas 1 Online Lender. 1200 400 400 2000.

10 Best Quick Personal Loans To Get Fast Emergency Cash Immediately

You need to make 138431 a year to afford a 450k mortgage.

. Ad Looking For A Mortgage. Ad Highest Satisfaction For Home Financing Origination. Apply And See Todays Great Rates From These Online Mortgage Lenders.

Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. See If Youre Eligible for a 0 Down Payment. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50. The standard salary to mortgage ratio used by lenders is 45 times an annual salary. The sum will be divided by 24 months to find your.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or. Thanks to the new. The 2836 DTI ratio is based on gross income and it may not include all of your expenses.

Calculate Your Monthly Loan Payment. The rule says that no more than 28 of your gross monthly income should go. Principal interest taxes and insurance.

This includes credit cards car. But a pediatrician with a. Its A Match Made In Heaven.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. An orthopedist with a student loan burden of 400K and an income of 400K also has a ratio of 1X. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

This includes credit cards car. Debt-To-Income Ratio - DTI. This means you can potentially borrow 45 times your annual salary as a mortgage.

Your monthly debt payments would be as follows. Lowest Home Financing Rates Compared Reviewed. To determine how much you.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. What More Could You Need. What is a Debt-to-Income Ratio.

The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000. The 2836 rule is an addendum to the 28 rule.

Find The Right Mortgage For You By Shopping Multiple Lenders. The standard salary to mortgage ratio used by lenders is 45 times an annual salary. In some cases we could find lenders willing to go.

The name for this rule comes from two measures of how. In your case your monthly. Apply Easily Get Pre Approved In 24hrs.

Ad Compare Mortgage Lenders. Ad Work with One of Our Specialists to Save You More Money Today. Maximum Student Loan Debt to Salary Ratio The White Coat.

We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income. Apply Today Enjoy Great Terms.

Tuesday Tip How To Calculate Your Debt To Income Ratio

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

2

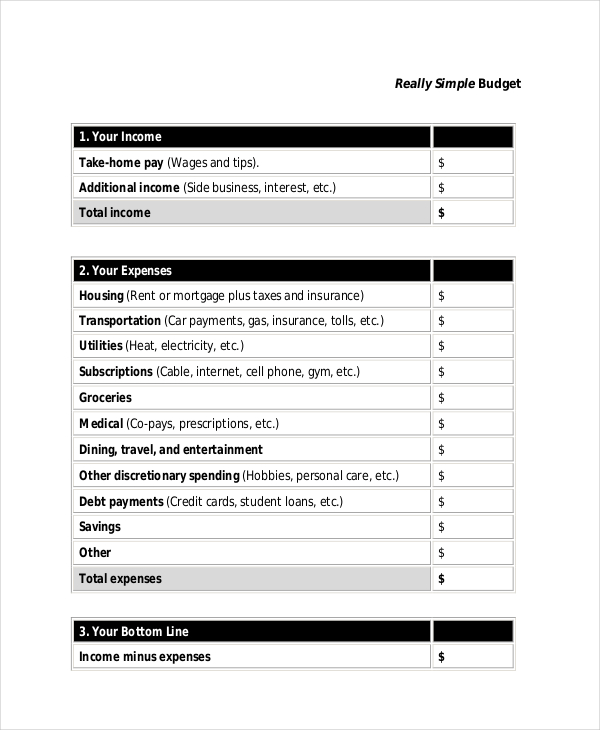

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Real Estate Tips

2

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

2

2

Pin On Personal Finance

Staffing Payroll Invoicing And Time Labor Software Timerack

Columbia Banking System Inc 2021 Annual Report 10 K

Awesome Debt Management Template Debt To Income Ratio Spreadsheet Template Excel Spreadsheets Templates

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Accounting Training

Free 9 Sample Household Budget Worksheet Templates In Ms Word Excel Pdf Google Docs Google Sheets

Nc10018789x1 Barchartsx3 Jpg

Nc10018789x1 Piemaiurix2 Jpg